Residents may carry on outside of entry acquisition for personal use, reasonable quantities imported articles within a total of 5000 RMB (including 5000), customs, shall be exempt from release. Oriental IC data

On April 8, the cross-border electronic commerce, retailing and import taxes the new deal. Unexpectedly, a tax policy for cross-border e-commerce, has set off ripples moment maxed "ring of friends". Micro letter and circulated on the Internet: some personal leave the shopping spectrum? Reporters for the first time spoke with authorities and experts.

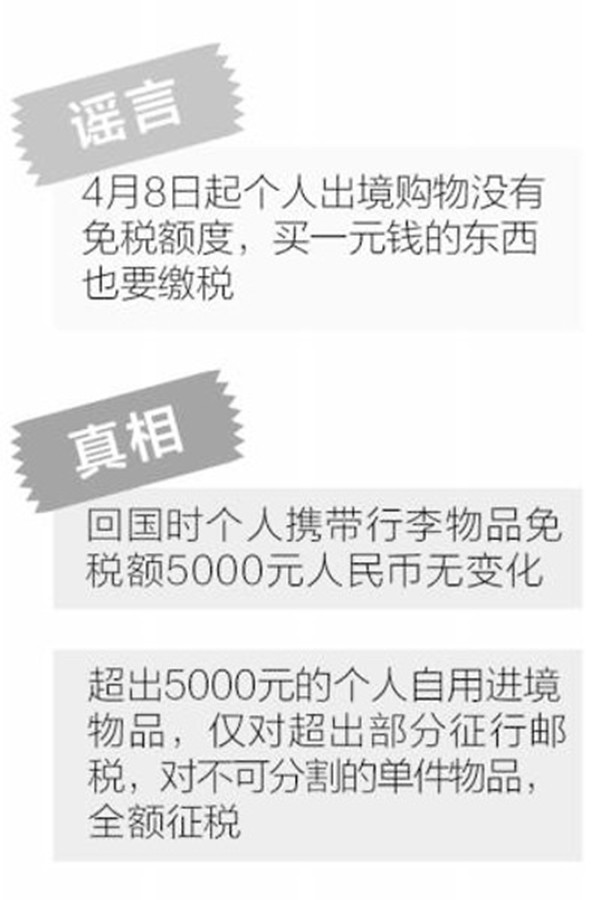

Personal baggage allowance of 5000 Yuan do not change, the portion according to the new standard and mail tax levy

"Today has been taxes, customs tells me the leader there is no tax credit buying things for a dollar to pay taxes. "9th micro-" ring of friends "forward this message widely, publishers say, cookies, masks, lipsticks and other carry-on items counted down, the value of 6000 Yuan pay 1916 Yuan. Due to the Publisher with "experience" account of events, many people believe.

"Do you have a shortage of cosmetic? Airport Terminal pick up, now throw rather than taxes. "The first day of the implementation of the new rules, erupted online when someone threw cosmetics, and" the photos don't lie. " Those rumors, cause a lot of worry: after going abroad or want to buy buy buy? When they return to land will be higher taxes?

Then, after April 8 whether personal exit shopping without tax credit? Buy one Yuan really pay any taxes?

"This claim is unfounded, whether to travel abroad, for business or visiting family and friends and return personal baggage allowance of 5000 Yuan do not change. "The Treasury official said, the adjustment is mainly cross-border e-commerce, retailing and import goods tax policy, and the stamp tax policy. Residents may carry on outside of entry acquisition for personal use, reasonable quantities imported articles within a total of 5000 RMB (including 5000), customs, shall be exempt from release.

"If purchased goods valued at more than 5000 Yuan, tax on excess tax by mail. "He explained that imported residents may carry more than 5000 Yuan for personal use of imported articles examined by the customs are for personal use, only the customs tax on personal use of excess imported articles, on an integral one-piece items, a full tax. According to come into effect on April 8, a new line of stamp tax taxable items and tax rates levied.

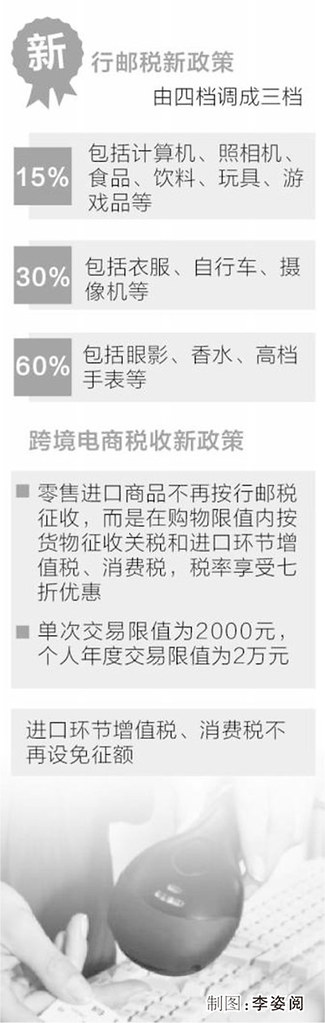

New mail tax rates from the four 10%, 20%, 30%, 50% into third gear, tax rates were 15%, 30%, 60%. 15% the rate of goods including computers, cameras, food, drinks, toys, games, etc; 30% the rate of goods included clothing, bicycles, cameras and other, 60% this document, products including eye shadow, perfume, high-end watches.

From this point of view, in accordance with the "Publisher" and belongings 6000 Yuan, if for personal use, a reasonable number, allowance for deduction of 5000 and 1000 Yuan would only be taxed, taxes would not be to 1916. Also, cosmetics skin care mail tax 30% also carry goods taxed more than 5000 Yuan. Hundreds of bottles of skin care products "would rather throw than taxes" say, credibility is not very high.

Of course, if the "Publisher" to carry large amounts of cosmetics immigrants, not for personal use, may have to face higher taxes. Last October, has photographed Chinese tourists in Korea airport to purchase a large quantity of cosmetics photos, photo cosmetic in piles on the floor, put alongside a lot of boxes and bags, large quantity at an alarming rate. That is clearly more than a "personal use" range, if, as is now so strict customs check, taxes to be paid by the parties is not a decimal.

Cross-border e-commerce single transaction limit of 2000 Yuan and 20,000 yuan for the year, will enjoy zero tariffs and import value-added tax, consumption tax hit 70 percent

There are rumors that "residents may return to single the year 2000 more than 20,000 tax in full baggage." This is baseless assertion, for cross-border e-commerce and individuals tax policy issues tax policy "confused".

Cross-border e-commerce tax policy has two main points: first, cross-border e-commerce, retailing and import goods by mail no longer tax levy, shopping but within limits, according to freight tariff and import value-added tax, consumption tax, tax rates can receive a 70 percent discount. Single transaction limit of 2000 Yuan, annual individual transaction limit of 20,000 yuan. Second amount should no longer be exempted from import VAT and consumption tax.

After the new deal, how big is the market?

Reporters found that these two days of cross-border e-commerce promotions, has begun from the previous "post" extends to the "tax package" to in front of a new round of changes in tax policy to attract customers, grab.

Before the new deal, many cross-border e-commerce platform takes this big "tax" promotions to attract consumers to stock up in advance, cat shop on international cross-border e-commerce platforms have made "don't buy price" and "dumped goods" slogan.

Baby honey buds specializing in baby products is a comprehensive cross-border e-commerce platform, announced that from 10 o'clock in the morning on April 8 honey buds, all cross-border brand milk powder for sale on the platform will be on the line, and launched the "milk tax package special" "diaper tax package special" "clothing with 199 reduced 60" and other incentives to attract consumers. Another cross-border e-commerce-paramita 8th announced that users of subsidies during the transition period, all users through a free trade zone after the order to get a "certificate", the coupons can be full of tax relief, and no maximum relief amount.

Integrated of across border electric business platform NetEase kaolahai purchased, is in Home launched has specifically for milk of "test pulled not price" activities, for different brand of milk issued different lines of "province tax subsidies coupons", as in edition of beauty praise Minister concert, user can received "full 299 reduction 40" and "full 399 reduction 50" of subsidies coupons, some sales more hot of milk brand as love he beauty,, no provides subsidies coupons, is clear marked "this commodity price has containing tax", while requirements "single times limited purchased 2 pieces".

However, although after April 8 number of websites have "tax package" policy, but there is a certain rise in commodity prices, although some commodity prices have not changed, but the original promotions such as coupons cannot be used again. Ms Yang, Beijing, Chaoyang District, usually buy baby products online, milk powder and diapers are the main procurement of goods. "On April 1, I bought baby Japan Kao diapers 3 Pack 309 is the price, 9th on the Internet, although no tax, but the price was 330. Fortunately early last month to buy 15 bags of diapers, enough children for several months. "

"Current 17% tax levy on imports of consumer goods in China, 70 percent of the final tax rate is equal to 11.9%, slightly higher than the mail 10% before tax. "The Chinese Academy of Social Sciences Institute of tax Research Director, Zhang bin, a researcher at the financial strategy believes that this cross-border e-commerce tax policy adjustment has little effect on ordinary citizens, not adding too much burden to consumers. But due to the cancellation are exempt from taxes, commodity taxes increase less than 500 Yuan. Like food, health care products, such as milk powder, diapers, on the increased tax burden is reflected in the price, also is cross-border e-commerce to digest, remains to be seen.

There are also "cut party" may think that amount is not enough: the annual individual transaction limit of 20,000 yuan, buy a bag several tens of thousands of Yuan, the "standard" do? In fact, consumers can still buy more than this limit, only that in accordance with general trade taxes in full and can no longer be 70 percent off. Overseas to badmouth argument is kind of soup

Only the items on the list may apply new tax system for cross-border e-commerce, and other products you will need to follow the mail or general trade imports

Recently, the cross-border electronic commerce, retailing and import commodities list to the public, and synchronize with the tax deal implemented. This means that only the list of goods imported under the cross-border e-commerce tax system, other products by mail or general trade imports.

Inventory consists of 1142 8-bit taxes, goods, mainly domestic demand for some consumer to meet regulatory requirements of relevant departments, and objectively by courier, mail or any other means from imported consumer goods, including food and beverages, clothing, hats, household appliances and some cosmetics, diapers, children's toys, mug, etc. Cross-border e-commerce, retailing and import tax policy to implement inventory management, primarily to avoid imports of industrial raw materials and other goods through cross-border e-commerce retail channels into China, disrupts the normal trade order and facilitate the day-to-day collection operations.

However, there are cross-border e-commerce has made difficult: as before and some have entered into a bonded warehouse of liquid milk products, have not been included in the list now, face the problem of unable to clearance sales. There are some baby formula, because there is no registration in accordance with the Food Safety Act, has not been included in the list. Reporters from the Mainland authorities that, had entered the zone and not listing the goods on how to deal with and related policies currently under study.

"For most Hai Tao Group, through cross-border e-commerce for imports while saving money, safety and high quality of foreign goods are also important factors. "Zhang thought, in regulating cross-border e-commerce development, as well as the closing of tax loopholes, should carry forward the" artisan spirit ", make great efforts to put the quality of products pushed consumer market to build up trust.

No comments:

Post a Comment