Fight for more than a year of "diplomatic battle for control of the" finally usher in a good moment. January 12 CR issued a bulletin, to be in agreement in the manner of his total holdings of about 1.69 billion shares of vanke a shares transferred to Shenzhen Metro, total transfer price was 37.17 billion yuan.

China resources exhausted exiting control struggle is no surprise. Treasure Holdings to 25.4%, beyond the China resources away from the biggest shareholder, and hang after entering, CRC's exit was only a matter of time.

However, if the dark iron disk access rights is China vanke's management had the last laugh, might not be entirely. After control right after the battle, vanke has not at this time when China vanke, this vicious struggle to make its existing problems have been fully exposed, the benchmark of the industry's reputation has been condensed into a legend.

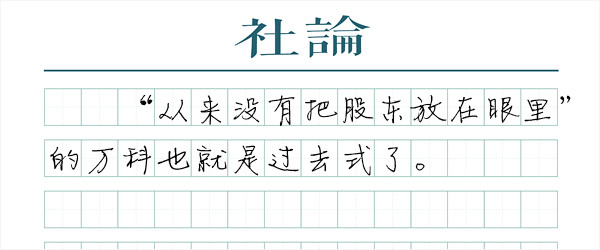

Has message said, last year December constant big on said, if need, willing to will its holds of equity transfer to deep iron, once constant big holds of vanke shares also all transfer to deep iron, deep iron will holds vanke 29.38% of equity, not touch touch 30% of offer acquisition bottom line, to regardless of is in Board, and shareholders Assembly, also is in business management layer, are has around situation of capacity. "Never looked down on shareholders" the vanke is a thing of the past. Wang's "go the right way, gold diggers", vanke, will eventually become an authentic place State-owned listed companies, Wang himself and vanke a true steward of the bosses and her mother-in-law.

That on the wanke perfect corporate governance structure is useful. On one hand, vanke's residual rights and decision-making power will eventually return to the shareholders and Board of Directors. In company law "Chinese system" and the principal-agent mechanism, shareholders, Board of Directors and management functions are relatively clear, and has a role of checks and balances and mutual promotion.

Once the relative majority of shares of vanke deep iron, shareholders ' interests are relatively concentrated, vanke's Board of Directors will be in balance shareholder and management interests in some game balance, will no longer be under the control of the management of the Board's "rubber stamp" discretionary space management will be converging, the self-interest of management risk issues will be somewhat improved.

The other hand, was exposed in a battle for control of the vanke insiders control problem, you will get predictable relief. Editorial is not flip misleading

In short, dark iron buyers spent from uncertainty to certainty in orbit, once the relative majority of shares of vanke, the shareholders say will improve, vanke will no longer be the once wanke. That on the wanke all stakeholders, will be one of the least bad outcome.

No comments:

Post a Comment